Building Trust Through Communication — How Cook County, Illinois Drove Adoption of Its Digital Real Estate Tax Filing System

In an era when local governments across the United States are increasingly pressured to modernize and deliver public services with greater speed, transparency, and efficiency, Cook County, Illinois, stands out as a pioneering example. Cook County—the second most populous county in the U.S.—launched a transformative initiative in partnership with Xerox to digitize the filing process for real estate deeds and taxes. This marked a major step forward in the county’s broader digital transformation goals and commitment to improved public service delivery.

In an era when local governments across the United States are increasingly pressured to modernize and deliver public services with greater speed, transparency, and efficiency, Cook County, Illinois, stands out as a pioneering example. Cook County—the second most populous county in the U.S.—launched a transformative initiative in partnership with Xerox to digitize the filing process for real estate deeds and taxes. This marked a major step forward in the county’s broader digital transformation goals and commitment to improved public service delivery.

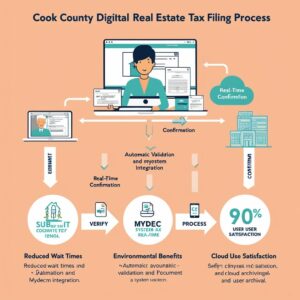

The implementation of a 24/7 electronic filing system, fully integrated with the Illinois Department of Revenue’s MyDec platform, revolutionized the way property transfer tax documents were processed. This case study explores the motivations behind the project, its operational details, the communication and engagement strategies employed, and the broader implications for government innovation.

Background: The Challenge of Paper-Based Systems

Cook County’s system for processing property tax declarations and deed filings was largely manual. Attorneys, title companies, and property owners were required to physically submit documents at designated offices, leading to long wait times, bottlenecks in processing, high labor costs, and risks of lost or mishandled paperwork.

The inefficiencies of this paper-based system not only frustrated constituents but also placed unnecessary strain on county resources. Additionally, inconsistencies in the manual processes led to delays in tax revenue collection, hindering other essential public services.

Recognizing the urgent need to modernize, the Cook County Recorder of Deeds and the Board of Review identified real estate tax filing and property assessment as high-impact areas for digital innovation.

The Initiative: Partnership with Xerox and Integration with MyDec

Cook County launched an electronic filing system in collaboration with Xerox, with the following core objectives:

- Streamline deed and tax document submission

- Eliminate manual errors and inconsistencies

- Enhance user experience for filers

- Enable real-time data integration with the Illinois Department of Revenue

The system allowed attorneys and other stakeholders to submit documents 24/7 electronically. It also connected seamlessly with the Illinois Department of Revenue’s MyDec platform, enabling electronic property transfer tax declaration, assessment verification, and stamp issuance.

Key Features of the System

- 24/7 Electronic Filing Access: Users could submit deeds and tax documents at any time, removing limitations related to office hours and holidays.

- Automated Validation: Built-in checks ensured data accuracy, flagging incomplete or inconsistent entries before submission.

- Integration with MyDec: The connection with MyDec allowed for instant verification and processing of property transfer tax declarations.

- Digital Stamp Authorization: Enabled real-time issuance of property tax stamps without in-person processing.

- Paperless Workflow: Reduced dependency on physical storage and enabled a searchable, digital archive for staff and public access.

Supporting Technology: Digital Appeals Processing System (DAPS)

In parallel, the Cook County Board of Review launched the Digital Appeals Processing System (DAPS) to replace paper-based property assessment appeals. DAPS enabled residents to:

- File appeals online

- Receive electronic notifications and updates

- Access digital hearing schedules and rulings

The combination of deed e-filing and digital appeals created a comprehensive modernization of the county’s real estate-related processes.

Communication and Stakeholder Engagement Strategy

Cook County recognized that the success of such a significant digital shift depended on proactive communication, stakeholder buy-in, and training. The county implemented a multi-pronged communication campaign to inform and engage the public:

- Press Releases and Public Announcements

- Official press releases highlighted the benefits of the new system: faster processing, cost savings, and 24/7 access.

- Statements from Recorder of Deeds Karen A. Yarbrough emphasized the county’s responsibility to improve public interaction.

- Website Launch and Resource Hub

- A dedicated section on the county’s website provided instructions, FAQs, downloadable guides, and video walkthroughs.

- Pages were optimized for mobile viewing and accessibility.

- Professional Outreach and Stakeholder Briefings

- Attorneys, title companies, and real estate professionals were invited to demo sessions.

- County officials hosted stakeholder meetings to answer questions and collect feedback.

- Onboarding and Training Materials

- Step-by-step user guides and printable checklists were made available.

- Hotline support and email assistance were staffed during the rollout period.

- Local Media and Earned Coverage

- County officials participated in interviews with Chicago-area media outlets.

- Success stories and case examples were featured in newsletters and newspapers.

- Internal Communications

- County departments were trained to reference and promote the new system.

- Departmental liaisons were established to support coordination and maintain consistency.

User Experience and Public Reception

The transition to electronic filing received strong support from the legal and real estate communities. Early adopters praised the system for its ease of use and time savings. Within the first year:

- Document processing time decreased by over 50%

- The volume of filings increased due to 24/7 accessibility

- Customer service inquiries related to missing or delayed filings declined significantly

Users noted particular satisfaction with:

- Reduced time spent in government offices

- Real-time confirmation of receipt

- Ability to track submissions digitally

Environmental and Financial Impact

The reduction in paper use, printing, and physical transportation of documents yielded environmental and operational cost savings:

- Fewer staff were required for manual document handling

- Storage needs for physical records were minimized

- Postage and courier costs declined for both the county and users

Metrics and Outcomes

The county tracked several KPIs to measure success:

- System Uptake: Over 85% of all deed and tax-related documents transitioned to e-filing within the first two years

- Processing Time: Average turnaround time dropped from 5–10 days to less than 48 hours

- User Satisfaction: Surveyed users gave the system a 90% satisfaction rating

- Internal Efficiency: Staff processing capacity increased by 35% without additional hiring

Lessons Learned and Ongoing Improvements

While the project was widely successful, Cook County acknowledged opportunities for further refinement:

- Mobile optimization for submission interfaces continued to evolve

- Language translation for non-English-speaking residents was identified as a priority

- Ongoing training was needed for less tech-savvy users

- Cloud-based integration was proposed to enhance future scalability

Broader Implications and Recognition

Cook County’s successful transition to electronic deed and tax filing systems garnered praise and was cited as a model by peer counties and municipal innovation conferences. The initiative:

- Demonstrated the viability of large-scale digital transformation at the county level

- Reinforced the value of inter-agency collaboration

- Highlighted the critical role of proactive communication in managing technological change

Conclusion: A Blueprint for Digital Public Service Delivery

The launch of Cook County’s electronic real estate tax filing system represents a landmark in local government modernization. By reducing paperwork, accelerating processing, and expanding access through seamless technology integration, the county has set a standard for 21st-century public administration.

This case study illustrates that successful digital transformation depends not just on software, but on thoughtful design, strategic partnerships, and a communication-first mindset. Cook County’s experience offers a blueprint for other jurisdictions seeking to enhance service delivery, build public trust, and drive innovation in civic finance.

Ready to Elevate Your Agency’s Public Communication?

We understand the unique challenges state and local government agencies face—from complex issues to diverse community needs. Our comprehensive approach can help you transform the way you connect with constituents, improve transparency, and highlight the valuable work your agency does every day.

Interested in learning more? Reach out to us today for a consultation. We’d love to discuss how our services can support your goals and help you build lasting trust with the communities you serve.